Robinhood stock Analysis

Robinhood Markets, Inc. (HOOD)

2025 Performance Overview

Robinhood delivered a standout performance in 2025, rising from approximately USD 35 to nearly USD 150 before undergoing a pullback. The move was supported by strong execution under CEO Vlad Tenev and a marked improvement in operating performance. Reported revenue reached ~USD 4 billion, with profits of ~USD 2 billion, implying an exceptional ~50% profit margin.

The rally reflected improved monetisation, higher user engagement, and favourable trading conditions across equities, options, and crypto markets.

Liquidity-Driven Business Model

Robinhood’s business model remains highly sensitive to market liquidity and retail participation.

- 2021: COVID stimulus payments, ultra-low interest rates, and speculative enthusiasm drove elevated trading activity in meme stocks and crypto, lifting HOOD to around USD 50.

- 2023: Rising inflation, higher rates, and reduced discretionary income among younger investors led to a sharp contraction in trading volumes, with the share price falling to approximately USD 9.

This pattern highlights a clear cycle: expanding liquidity supports Robinhood’s earnings, while tightening liquidity compresses them.

2026 Outlook: Liquidity Upside Scenario

Looking ahead to 2026, potential policy shifts could materially influence market liquidity:

- A Trump-led administration may pursue lighter banking and lending regulation.

- Changes in Federal Reserve leadership could increase the probability of interest rate cuts.

If these factors materialise, they could:

- Reignite retail trading activity

- Increase speculative participation

- Drive higher transaction volumes and platform revenues

Under a liquidity expansion scenario, Robinhood may benefit disproportionately compared with traditional brokerage platforms.

Key Risks

The upside case is accompanied by meaningful risks:

- Renewed inflationary pressures driven by rate cuts and tariffs

- Pressure on employment, real wages, and GDP growth

- Reduced discretionary trading activity among younger investors

A weaker consumer environment would likely translate into lower platform engagement and slower revenue momentum.

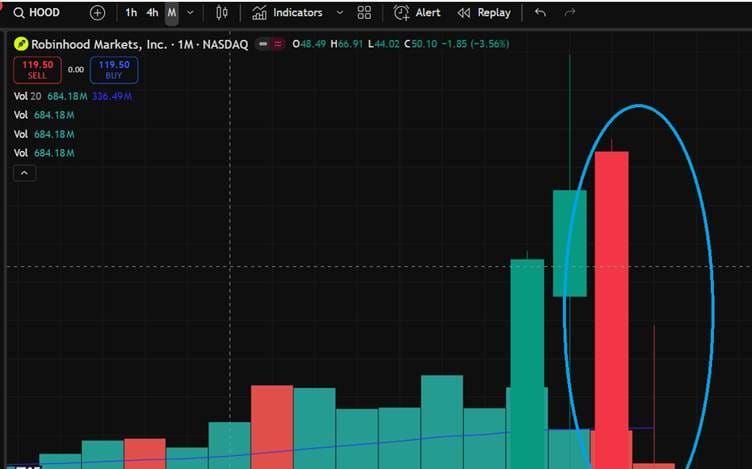

Near-Term Price Action

In the near term, HOOD has declined on elevated trading volume, following reports of weaker trading activity in November.

Observed technical areas (descriptive, not predictive):

- Initial support: USD 118

- Secondary support: USD 102

- Deeper support: USD 93

Given the recent heavy-volume decline, I am waiting for clear signs of renewed buyer interest before reassessing the near-term outlook.

Important Non-FCA Disclosure

This content is provided for general information and opinion purposes only. It does not constitute financial promotion, investment research, investment advice, or a recommendation under UK Financial Conduct Authority (FCA) rules. No consideration has been given to the investment objectives, financial situation, or needs of any individual. Investing involves risk, including the possible loss of capital. Past performance is not a reliable indicator of future results. Readers should undertake their own research and seek advice from an authorised financial professional before making any investment decisions.